Selling Puts and Bear Markets

Can You Safely Sell Puts in a Bear Market? (Video and Article)

Wouldn't it be nice if there was a single option strategy that you could use in pretty much any market environment?

Something easy to work with?

Something that didn't take a big chunk out of your portfolio if you happened to be wrong on a trade?

Now, I'm not talking about some magic option strategy that you just blindly and mechanically trade - I'm talking about a strategy that's flexible enough to adapt to different market environments.

And forgiving enough that if something goes wrong, you've got an excellent shot of fixing it.

I love selling puts (on the right stocks and under the right conditions) and do so in abut 90% of my own trades because flexible and forgiving is exactly what it is.

So that's what we're going to explore here - whether selling puts (which can work great in bull markets and even flat markets) can also do well in bear markets?

In other words, can you safely sell puts in a bear market and continue generating low risk, high yield income?

And the answer is . . .

Probably the best way to answer that is to consider the following three insights . . .

#1 - Bear Markets Are Not As Bad As You Think for Put Sellers

It's a contrarian position, I know, but a bear market is not the end of the world - even for put sellers (who are basically insuring or offering to buy stocks at a certain price and hoping they don't trade lower).

That's because:

>> Not everything goes down in a bear market

There are always going to be certain "defensive" stocks and sectors that hold up well in a bear market.

There are often some "usual suspects" but it will also depend on the nature of the bear market in question.

During the Financial Crisis and Great Recession, for instance, McDonald's, Walmart, and dollar stores were all great harbors from the storm.

>> Even in a bear market, the stocks that do go down don't go straight down

Even stocks in a downtrend don't go straight down - they take breathers, they get technically oversold and bounce, they have to slow down and work through support levels before the next leg lower.

So there are often opportunities to capitalize on near term "limited downside situations" even if the longer term trend is down.

>>There's actually a positive aspect of bear markets - option implied volatility (IV) levels tend to spike higher and stay there

What that means is that the price of options go up a lot.

And as net option sellers, that's good news.

It means we get paid a lot more in bear markets.

So we can afford to up our trades more conservatively and, ironically, that elevated IV can actually make it easier for us to adjust our trades and make repairs.

#2 - Bear Markets Are Happening All the Time - in Individual Stocks

The main reason I don't fear bear markets is because I'm already used to them.

With our unique value investing with options approach, we often deal with stocks that are attractively valued and well off their highs anyway.

Sometime that means they've already fallen a lot!

The Sleep at Night High Yield Option Income Strategy (our customized, value investing oriented, put selling strategy) has an investor-friendly trade management and trade repair process that's:

>> Flexible

>> Forgiving

>> Capital Efficient

>> Highly Effective

In the video above, I share a couple of impressive short put trade repair examples:

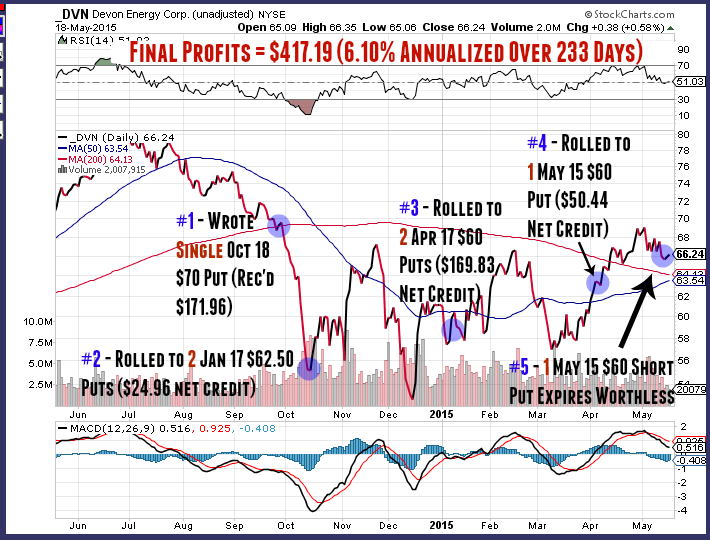

>> I detail a 2014 short put position I had on DVN just as the energy crash was getting underway.

The stock cratered from right around $70 into the low $50s, but I was still able to repair and extricate myself from the trade with 6.10% annualized returns over 233 days.

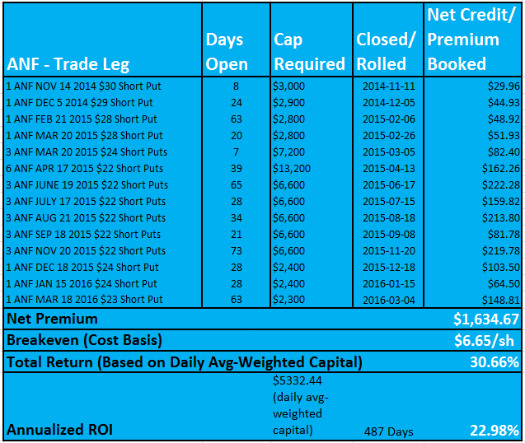

>> I also talk about the "Legendary ANF Trade"

At the time I originally recorded the video, that trade was still active. It's since been concluded and the final results are even more impressive.

I banked 30.66% total returns over 487 days (or 22.98% annualized) even as the stock - get this - dropped an insane 49.94% after I entered the trade.

Even crazier, the broader market - as tracked by the $SPX - was actually down a bit over the same time period (early November 2014 through early March 2016).

Time Out!

A bear market is defined by a decline of 20% or more.

So both of these stocks definitely hit that target - even if you only count the subsequent declines they recorded AFTER I entered the trade.

And not only was I able to avoid substantial, even catastrophic losses, but both were actually profitable, and in the case of ANF, spectacularly so.

The ANF trade is especially significant - and not just because of the fantastic returns it produced.

It shows how powerful the Sleep at Night Strategy can be when you combine two factors I highlighted earlier:

>> The effectiveness of the 4 Stage Short Put Trade Repair Formula

>> The huge tailwind of working with options with extremely high implied volatility levels priced into them

(And, yes, I could list more short put trades where I was able to do the same thing - still make money at the end of the day even though the underlying stock sold off after I entered the trade.)

Some Additional Takeaways

>> The Sleep at Night Strategy is not a generic or binary trading event where you either make money if you're right or you lose money if you're wrong

>> It's a customized and dynamic strategy because we can manage and adjust it in such a way that our cost basis or breakeven on the trade goes lower every time we touch it

>> This campaign mindset (vs. the single trade mindset) gives us ultimate flexibility

>> Just because a stock zags lower instead of zigs higher, that doesn't mean we have to accept a loss or that we're screwed

#3 - We Don't Have to Sell Puts at All Times

Finally, I'll just state what should be obvious.

We can - and should - be adaptable and flexible when it comes to wielding the Sleep at Night Strategy.

As I said at the outset of this newsletter, I'm not suggesting we blindly and mechanically sell puts the same way at all times regardless of market conditions.

(If we ever get a return to those thousand point intraday price swings we saw in the DJIA in October 2008 - thanks to general market panic and all those "smart money" pros getting margin calls and being forced to liquidate their positions - there's no shame in moving to the sidelines.)

We need to be able to adapt to different market environments.

But does that mean we adapt by modifying the Sleep at Night Strategy, or does it mean we replace it with something else entirely?

Realistically, it's probably a little bit of both.

I mentioned this earlier in Section #1 above, but in a bear market with high implied volatility option pricing, since we're getting paid a lot more to sell puts, we can set up our trades much more conservatively.

We can also scale things back and be much more selective about what trades we do enter.

And - gasp! - we can even be open minded about rounding things out by occasionally incorporating other strategies.

In the video, I specifically mentioned a version of LEAPS based calendar or diagonal spread trading that can be calibrated for either bull markets or bear markets.

I'm also open to the idea of selling calls in the form of bear call spreads (on a very limited basis!).

But I have a contrarian view in that I believe the only safe credit spread is one that you can convert back into a naked/uncovered position if you need to repair it.

(Otherwise it can be difficult and expensive - if not downright impossible to repair - so be careful of overleveraging!)

But - and this is also a conversation for another day - repairing an in the money runaway short call trade can be much more difficult to repair than doing the same to an in the money runaway short put trade.

Option Trading + Value Investing Makes Us Better Traders and Investors

OK - bottom line - once you get past the generic and encyclopedic definitions of the strategy, put selling really can be the mainstay strategy of anyone looking for a safe, all weather high yield income strategy.

Call it the Power of Renegotiation - the ability to repeatedly adjust and improve a trade allows us to interact with the stock market in a way that most pros can't and in a way that most retail traders and investors don't even know is possible.

It's kind of like a legal form of cheating, and even better, it's a lot of fun!

If something goes wrong, I can almost always fix it, and if I can't fix it, I’m still going to be able to seriously limit the damage.

I’ve found this to be a structurally sound and structurally advantageous approach to dealing with Mr. Market – he may have size and strength, but we have intelligence, flexibility, and a better understanding of basic mathematical principles.

And we play by our rules rather than by his.

Or rather, we play a game where we’re allowed to change the rules and he isn’t.

HOME: Selling Puts and Bear Markets

>> The Complete Guide to Selling Puts (Best Put Selling Resource on the Web)

>> Constructing Multiple Lines of Defense Into Your Put Selling Trades (How to Safely Sell Options for High Yield Income in Any Market Environment)

Option Trading and Duration Series

Part 1 >> Best Durations When Buying or Selling Options (Updated Article)

Part 2 >> The Sweet Spot Expiration Date When Selling Options

Part 3 >> Pros and Cons of Selling Weekly Options

>> Comprehensive Guide to Selling Puts on Margin

Selling Puts and Earnings Series

>> Why Bear Markets Don't Matter When You Own a Great Business (Updated Article)

Part 1 >> Selling Puts Into Earnings

Part 2 >> How to Use Earnings to Manage and Repair a Short Put Trade

Part 3 >> Selling Puts and the Earnings Calendar (Weird but Important Tip)

Mastering the Psychology of the Stock Market Series

Part 1 >> Myth of Efficient Market Hypothesis

Part 2 >> Myth of Smart Money

Part 3 >> Psychology of Secular Bull and Bear Markets

Part 4 >> How to Know When a Stock Bubble is About to Pop